Discover Your Dream Mortgage:

- Serving California

- 925-397-3295

- sam@loanguru.us

May 2025 mortgage rates are holding steady following the Federal Reserve’s recent decision to maintain the federal funds rate at 4.25%–4.5%. This stability offers buyers and homeowners a chance to breathe in an otherwise uncertain market. While rates remain elevated compared to pandemic-era lows, the pause signals a level of control over inflation and a cautious optimism in the economic outlook. For potential buyers, this is a chance to assess affordability and take advantage of a more balanced lending environment.

Federal Reserve Holds Rates Amid Economic Uncertainty

On May 7, 2025, the Federal Reserve announced its decision to leave interest rates unchanged for the third straight meeting. This decision reflects concerns over persistent inflation, slowing consumer demand, and external factors like trade tensions and global instability. Fed Chair Jerome Powell emphasized the need for a data-driven, cautious approach. While the economy continues to show underlying strength, the Fed is watching closely for signs of recession or inflationary rebound—both of which could influence future rate decisions.

As of May 8, 2025, mortgage rates across various loan types are relatively consistent, maintaining a range that presents both challenges and opportunities for borrowers:

Conventional 30-year fixed: 6.829% (APR 6.886%)

FHA 30-year fixed: 6.869% (APR 6.925%)

VA 30-year fixed: 6.926% (APR 6.969%)

These May 2025 mortgage rates reflect a market that’s not in a rush to climb higher—giving qualified buyers the chance to secure financing without the urgency that dominated much of 2020–2022. While rates are higher than historic lows, they’re also far from the peaks of previous decades, keeping ownership within reach for many (Source: The Mortgage Report)

At Loanguru Mortgage, we’re not just here to quote numbers—we’re here to give you clarity and control. Unlike lenders who require extensive personal details before sharing a rate, we offer real-time, customized rate quotes with no personal information needed. This lets you shop smart and compare without pressure. And because we monitor the market daily, we’re confident our rates are among the most competitive in the industry. When you see what we offer, you’ll understand why buyers consistently choose us to finance their homes.

Implications for Homebuyers

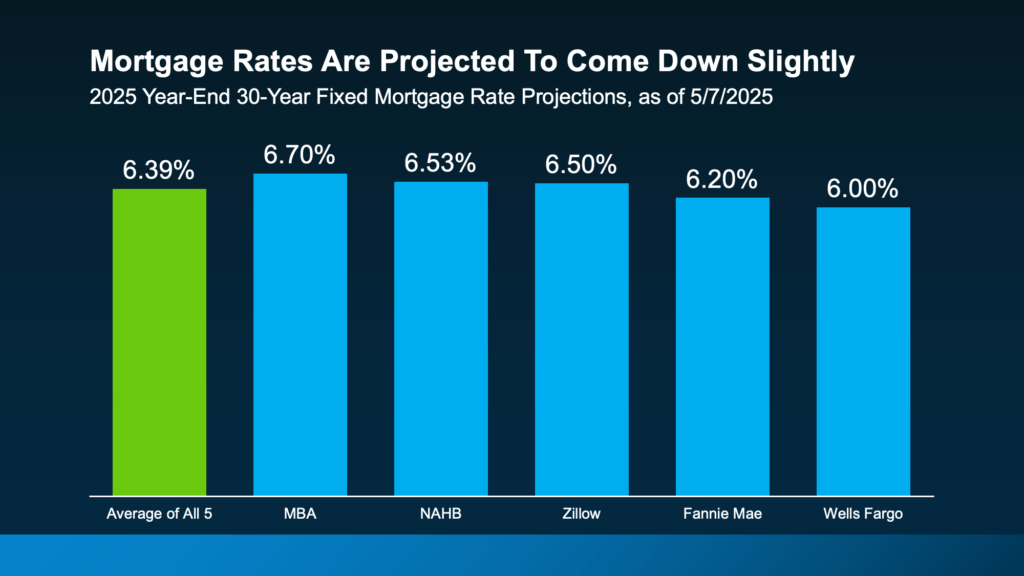

While the Fed’s decision provides a degree of stability, potential homebuyers should remain vigilant. Economic indicators suggest that while rates may not rise imminently, they are unlikely to decrease significantly in the short term. Therefore, if you’ve identified a suitable property and are financially prepared, it may be advantageous to proceed with your purchase, capitalizing on current rates and the possibility of refinancing should rates decline in the future.

May 2025 mortgage rates remain steady following the Fed’s decision to hold interest rates at 4.25%–4.5%. As of May 8, 2025, conventional 30-year fixed rates average 6.829%, FHA loans sit at 6.869%, and VA loans at 6.926%. This stability creates a window of opportunity for buyers to act before any future rate shifts. At Loanguru Mortgage, we offer live market rates tailored to your exact scenario — no personal info required. Compare us with other lenders and see why our rates are tough to beat. Check today’s real-time rates and plan your move confidently.

Step into a hassle-free mortgage journey. From inquiry to approval, our streamlined process ensures a smooth transition to your next home chapter.

Navigate homeownership complexities confidently. Our Instant Mortgage Rate Calculator reveals the savings our low rates can bring to your budget. Ready for clarity on your mortgage affordability? Schedule a consultation today.

Loanguru Mortgage LLC is a licensed mortgage broker. NMLS ID # 2439615. Licensing: California-DFPI Finance Law License. License# 60DBO-177169. All loans originated by Loanguru Mortgage are funded by third-party lenders. © 2023 Loanguru Mortgage LLC.